OverActive Media stock forecast 2025-2030: Will the OAM share price reach its ceiling?

- Details

TL;DR

- OverActive Media has seen its stock price increase by almost 22% in 2025 due to increased revenue and business developments.

- The company owns Movistar KOI and Toronto Ultras, two prominent esports organisations operating in games such as League of Legends and Call of Duty.

- OAM reported revenue of CAD$8.36 million for the second quarter of 2025, up 26% from CAD$6.61 million for the corresponding period last year.

- It launched ActiveVoices, an AI-powered real-time language localisation platform, providing translation, dubbing and multi-platform publishing for creators and brands.

- In addition to esports teams, the company operates a digital media agency, an influencer agency, a content production studio, and a live events business.

OverActive Media, which owns the Movistar KOI and Toronto Ultra esports brands, has seen its stock price rise almost 22% during 2025.

This increase has been fueled by a sharp rise in revenue, the launch of an AI-powered platform, and hopes that margins will expand.

But longer-term investors in the Canadian-based company won’t be celebrating as shares have actually fallen 85% since it went public in 2021.

In our OverActive Media stock forecast 2025-2030, we review its business interests, examine its latest results, and consider what potential investors can expect.

OverActive Media stock forecast 2025–2026: One-year OAM stock projection

The problem with investing in small companies is that they’re not closely followed by stock market analysts.

Whereas the multi-billion-dollar corporate giants have numerous investors poring over their accounts, those at the other end of the scale are often overlooked.

This can make it a nightmare for individual investors who have to form judgment calls on stocks without access to professional advice.

For example, the algorithmic forecasts of Wallet Investor, the OAM share price is only expected to rise modestly to CAD$0.34 over the coming year.

This would be a 21% increase over the CAD$0.28 closing price as the stock market closed on October 14, 2025. The site brands OAM stock as an “acceptable” long-term (one-year) investment.

| One-year OverActive Media stock forecast (as of October 14, 2025) | |

|---|---|

| WalletInvestor | CAD$0.34 |

OverActive Media stock predictions

How about the longer-term OAM stock prediction? What are the OverActive Media stock predictions of analysts and algorithmic forecasters for the next five years?

As we have already mentioned, an accurate OverActive Media share price forecast is very difficult as the company isn’t widely followed by professional investors.

OverActive Media stock forecast 2027–2030: Longer-term prospects

| Long-term OAM stock forecasts (as of October 14, 2025) | ||

|---|---|---|

| Year | October 2027 | October 2030 |

| WalletInvestor | CAD$0.36 | CAD$0.44 |

OAM stock YTD, one-year & five-year performance analysis

OverActive Media stock year-to-date: +21.7%

A solid 26% increase in second-quarter earnings has helped push up the OAM share price by almost 22% since the start of 2025.

Image credit: Yahoo Finance

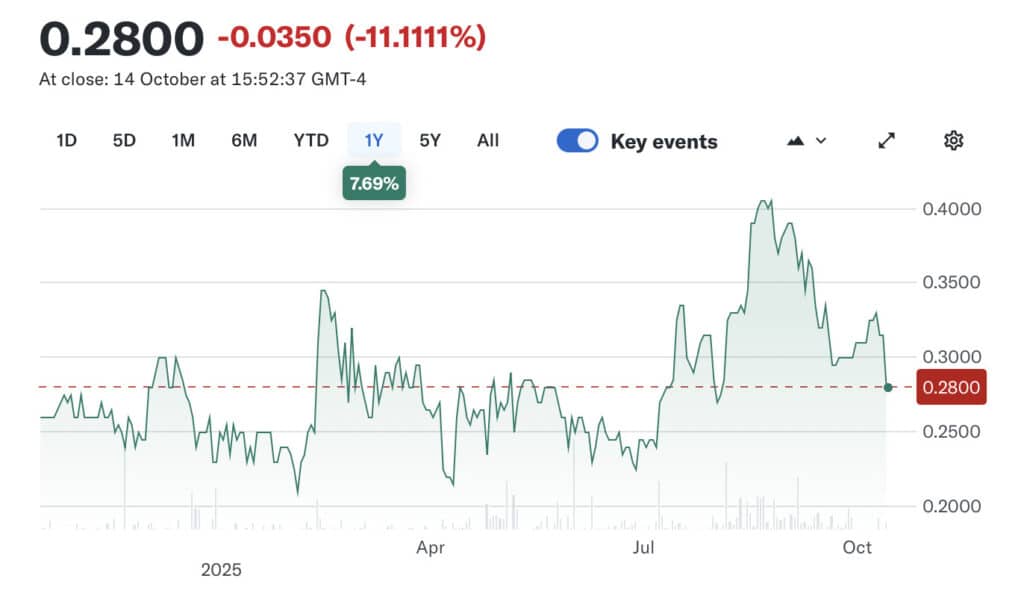

Image credit: Yahoo FinanceOverActive Media stock one-year performance: +7.69%

The OAM stock price is up by almost 8% over the past year. It had risen significantly when quarterly results were announced in August 2025, but has since fallen back.

Image credit: Yahoo Finance

Image credit: Yahoo FinanceOverActive Media stock five-year performance: -85%

Shares were valued at CAD$2.25 when it went public in July 2021, but the OAM stock price has since declined due to financial losses and a challenging market backdrop.

Image credit: Yahoo Finance

Image credit: Yahoo FinanceLatest earnings results

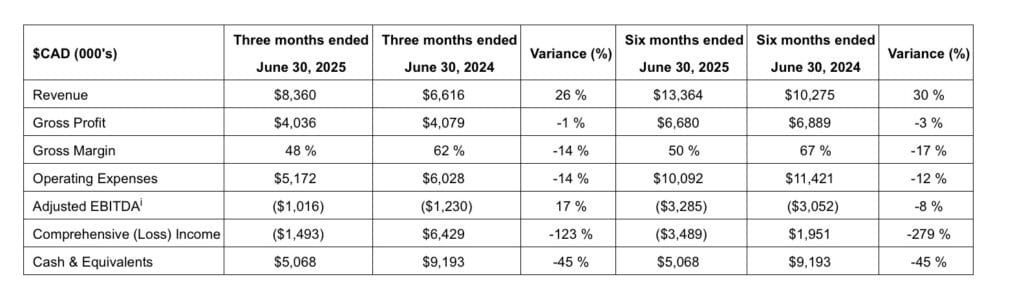

In August 2025, OverActive published its financial results for the three months to the end of June 2025.

These showed revenue of CAD$8.36 million, which was up from CAD$6.61 million in the same period last year.

This 26% uplift was driven by strong growth in its Business Operations division, led by events and agencies, which offset lower league revenues.

In a statement, Adam Adamou, OverActive’s chief executive, explained that the quarter had been about delivery and discipline.

He said: “These results demonstrate our ability to create demand, deliver premium fan experiences, and convert them into revenue across regions.”

Adamou also highlighted tight cost controls that brought operating expenses down 14% even though the company invested in rosters and production capacity.

“The quarter’s margin profile reflects a deliberate mix shift toward events and agency work; we expect that to rebalance in the second half as higher-margin league-share and digital merchandise come through,” he said. “With a cash position of $5.1 million and positive working capital, we’re set up to expand margins and keep moving toward our profitability objectives.”

Operating expenses decreased 14% to CAD$5.17 million from CAD$6.03 million, reflecting lower restructuring and business development costs.

However, it recorded a comprehensive loss of CAD$1.49 million, compared to a comprehensive CAD$6.43 million income for 2024’s second quarter. The previous year benefited from a “non-recurring CAD$9.8 million gain”.

Source: OverActive Media

Source: OverActive MediaDivision performance

Digging deeper into the company’s results, revenues for Team Operations fell just over CAD$1 million to CAD$1.15 million during the quarter.

This reflected a shift in payment structure from a higher annual minimum guarantee in 2024 to a lower base guarantee supplemented by milestone-based incentives in 2025.

The elimination of the Counter-Strike (CS) roster also meant it lost the opportunity to sell digital goods and stickers.

However, revenue for Business Operations rose CAD$2.77 million to CAD$7.2 million, primarily due to two events: LEC on the Road and the Call of Duty Championship Weekend.

OverActive Media business areas

OverActive has two distinct divisions: team operations and business operations. Let’s take a look at each in a bit more detail.

Team operations

OverActive runs elite competitive esports teams under two brands: Movistar KOI and Toronto Ultra. It earns income from performance-based revenue and tournament prize winnings.

Movistar KOI, a Spanish organisation, is its flagship brand that has been involved in League of Legends, VALORANT and Free Fire. Toronto Ultra, meanwhile, plays Call of Duty.

Business operations

This includes all the company’s commercial activities, such as sponsorship and partnership programs, merchandising, original content, and fan experiences.

OverActive also runs a digital media agency, an influencer agency, a content production studio, and a live events business.

High-profile partners

OverActive has signed partnerships with a number of globally recognised brands, including energy drink Red Bull, fashion group Kappa, Monster Energy, and Blacklyte.

Other OverActive Media news

Regarding other OverActive media news, the company has been active since the end of its second quarter in June 2025.

Launch of ActiveVoices

It introduced ActiveVoices, an AI-powered real-time language localisation platform, providing translation, dubbing and multi-platform publishing for creators and brands. It plans to roll out the KOI Voices pilot program, integrating ActiveVoices technology into Movistar KOI content.

Showcase at China Esports Conference

It presented its vision for the future of esports, digital media and AI-powered content creation at the prestigious China Esports Conference in Shanghai.

Esports World Cup

Toronto Ultra (competing as Movistar KOI) finished third at the Esports World Cup, earning $200,000.

What is the outlook?

What is the conclusion of our OAM stock analysis? Well, there are clear pros and cons when it comes to the question of whether you should invest in OverActive Media.

Firstly, the company is clearly ambitious and operates in a fast-growing, exciting market area expected to expand in the coming years.

Revenue has been increasing sharply, and continued growth will be necessary to maintain the OAM stock price over the coming year.

However, a bonus is that OAM has a diversified portfolio of interests, including teams, a digital agency, and live events. Therefore, it’s not overly reliant on just one area.

What is OverActive Media?

OAM is a global esports and entertainment organisation that’s focused on creating immersive experiences for players and fans.

The company was listed on the Toronto Venture Exchange (TSXV) on July 14, 2021, after completing a merger with Abigail Capital Corporation.

It has declared its mission to be: “We build teams, communities and experiences that engage, resonate and inspire generations of fans.”

OAM’s teams are Toronto Ultra, a powerhouse name within Call of Duty, and Movistar KOI of Spain, known for its success in League of Legends.

In addition to running teams and leagues, it’s involved in event production and the provision of gamer-centric content and merchandise.

While its headquarters are in Toronto, Canada, it also has operations in Madrid, Spain and Berlin, Germany.

Conclusion: Should I buy OAM stock?

This is a decision you must make based on your personal circumstances, attitude to risk and view of the company’s prospects.

Of course, the company’s shares are very cheap. As the stock market closed on October 14, 2025, they were priced at just CAD$0.285. However, that doesn’t automatically mean it’s worth putting your money into the esports company. You will need to consider the evidence and make your own call.

Trading carries financial risk and can lead to losses. Always conduct your own analysis and never invest more than you can afford to lose.

FAQs

Is OverActive Media stock a good buy?

You will need to answer this question based on the opinions of stock market analysts and your own opinions. Remember that even professional investors can make mistakes. Your OAM share price forecast should consider recent newsflow, comments from the company and views of the wider market.

What is the price prediction for OverActive Media in 2025?

Opinions are divided. According to the algorithmic forecast of WalletInvestor, the OAM share price could rise to CAD$0.34 over the coming year.

Is OverActive Media stock overvalued?

This is something you’ll need to decide. The OverActive Media stock forecast of WalletInvestor suggests it could rise further by a modest amount over the next 12 months.

What is OverActive Media?

OAM is a global entertainment organisation whose interests include running esports teams, a digital media agency, an influencer agency, a content production studio, and a live event business.

REFERENCES

The post OverActive Media stock forecast 2025-2030: Will the OAM share price reach its ceiling? appeared first on Esports Insider.

PROČITAJ VIŠE... https://esportsinsider.com/overactive-media-stock-forecast

MIXTV PUSH

VEZANE VIJESTI ZDRAVLJE

Fnatic Razork at Worlds 2025: “I just think we are not playing well as a team”

Putujete i strahujete od jet laga? Evo zašto nastaje i kako ublažiti simptome

KT Rolster and Anyone's Legend secure Quarterfinals spots at Worlds 2025

Battlefield 6: Best settings to make combat easier

Marvel Rivals Ignite Grand Finals Group Stage teams revealed

Anyone’s Legend and KT Rolster qualify for League of Legends Worlds 2025 Knockout Stage

OverActive Media stock forecast 2025-2030: Will the OAM share price reach its ceiling?

VIDEO Birajte sebe na prvo mjesto – vježbajte uz Ordinaciju.hr

Esports Global launches $50m investment fund

POPULARNO

Xiaomi exec compares the 17 Pro Max to the iPhone 17 Pro Max, reveals more details

Xiaomi predstavio novu generaciju AIoT uređaja za pametni dom, nosive uređaje i zabavu

U Njemačkoj se gradi najviša vjetroturbina na svijetu, visoka 365 metara

Day one iOS 26 updates arrives for iPhone 17 trio and Air

Samsung će na pametnim frižiderima emitirati – reklame

Gearboxov trenutni prioritet je poboljšanje performansi Borderlandsa 4 na PC-ju

Xiaomi ima i nove tablete i televizore: REDMI Pad 2 Seriju i TV S Pro Mini Led Seriju 2026

Znate li kako automatizirati poslove u Windowsima? Evo nekoliko preporuka

Samsung odgodio predstavljanje naglavnika koji će konkurirati Appleovom Visionu Pro

Predstavljena Xiaomi 15T serija - uz Leica kameru i profinjeniji dizajn

Deals: Claim free Galaxy Watch7 with Galaxy S25, iPhone 17 series and Air on sale

Xiaomi Watch S4 41mm, Xiaomi OpenWear Stereo Pro go global

Umjetna inteligencija mogla bi povećati svjetsku trgovinu, prognozira WTO

vivo Y50i is official with one tiny minute change from the Y50 and Y50m

iFixit takes the iPhone 17 Pro apart: the new design presents new challenges for repairs

Predstavljen program Europske noći istraživača u Dubrovniku

Apple priprema Vision Pro s 2-nanometarskim R2 čipom

iQOO 15 visits Geekbench and sets new record, built-in Q3 gaming chip to be detailed soon

Google Pixel 10 series users can now join the Android Beta program

Jaguar Land Rover zbog hakerskog napada i dalje ne proizvodi vozila

Samsung Galaxy S26 Ultra's charging speed corroborated by tipster, won't be 65W

iPhone 17 Pro Max pre-order delivery in the US slips to October

'DNK kazeta' čuva ogromne količine podataka stotinama godina

Youtuberi primijetili pad broja pregleda, iza svega je možda tihi rat protiv adblockera

Report: Samsung tri-fold phone could launch in the US

Huawei Watch GT 6 i GT 6 Pro stižu s još boljom autonomijom i korisnim značajkama za bicikliste

Apple's next Vision Pro to sport the self-developed R2 chip

Tanak preklopnik impresivne konstrukcije: Testirali smo Honor Magic V5

Meta unveils Ray-Ban Display and Ray-Ban Meta (Gen 2) smart glasses

Global OnePlus 15 model number confirmed through new certification

Musk se, nakon napuštanja politike, sve viša bavi svojom xAI tvrtkom

NASA odabrala Blue Origin za dostavu VIPER rovera na Mjesečev Južni pol

Nakon retro desktopa, stigao i retro toranj iz SilverStonea

ViewSonic LSD400 – Laserska preciznost, visoka svjetlina i dugovječnost u jednom uređaju

Studio Horrified Triangles: “Zvuk je oružje horora”

Xiaomi predstavio REDMI Pad 2 Pro Seriju - veliki tablet za profesionalnu zabavu i TV S Pro Mini LED Seriju 2026 - televizore s kino doživljajem u domu

Blend: Film Games 2025 - još više međunarodnih gostiju i radionica

Slušalice Nothing Ear (3) stižu s novim dizajnom i boljim poništavanjem buke

Philips Evnia 27M2N5901A je IPS gaming monitor s 4K rezolucijom, Ambiglowom i Dual Mode načinom rada

Google integrira Gemini AI funkcionalnosti u preglednik Chrome

AI alati sve popularniji među Hrvatima, no strahovi i zabrinutost postoje

Trump produžio rok za prodaju TikToka do 16. prosinca

Ayaneo's new Android-based Pocket Air Mini retro gaming handheld has a 4:3 display

Google announces new Rope Wristlet accessory for Pixel phones

Garmin Bounce 2 kids smartwatch debuts with two-way calling, new design

Krenuo porinuti jet ski, pa porinuo svoj BMW sedmicu

Huawei Watch Ultimate 2 is 150m dive-proof and debuts underwater sonar-based communication

vivo shares 4K 120fps videos from the vivo X300 Pro

Nothing OS 4.0 announced with refined design, updated dark mode and quick settings

Huawei Watch GT 6 and GT 6 Pro announced with bigger batteries, new sports and health features

Huawei nova 14 series, Freebuds 7i go international

Kineski predsjednik odobrio prodaju TikToka Amerikancima

Xiaomi predstavio Xiaomi 15T seriju: spoj vrhunskih kamera, najmodernije tehnologije i prestižnog dizajna

Ming-Chi Kuo: Apple will add a touchscreen to the upcoming MacBook Pro with OLED display

Novi skandal: Američka granična policija nezakonito prikupljala DNA vlastitih građana

Huawei Watch GT 6 Pro in for review

Apple iPhone 17 in for review

U Argentini otkriven novi dinosaur

Krade li vam datoteka za hibernaciju gigabajte prostora na disku ili SSD-u?

Jesenska ponuda na MMORC.com - originalni Office 2021 Pro samo 32 €, Windows 11 Pro samo 14 €